Energy Outlook Winter 2022-2023

2022 proved to be a volatile year in energy, with natural gas prices reaching record highs, and storage levels remaining below the 5-year average. The historical volatility, a measure of the magnitude of daily changes in closing prices for a commodity during a given time in the past, of natural gas futures prices at the Henry Hub has corresponded with high volatility at international pricing hubs in Europe and Asia and hit a 20 year high earlier this year. As we round out 2022 and edge our way into winter, the top question we’re fielding is: what can organizations expect from the energy markets over the next few months?

The Impact from Weather

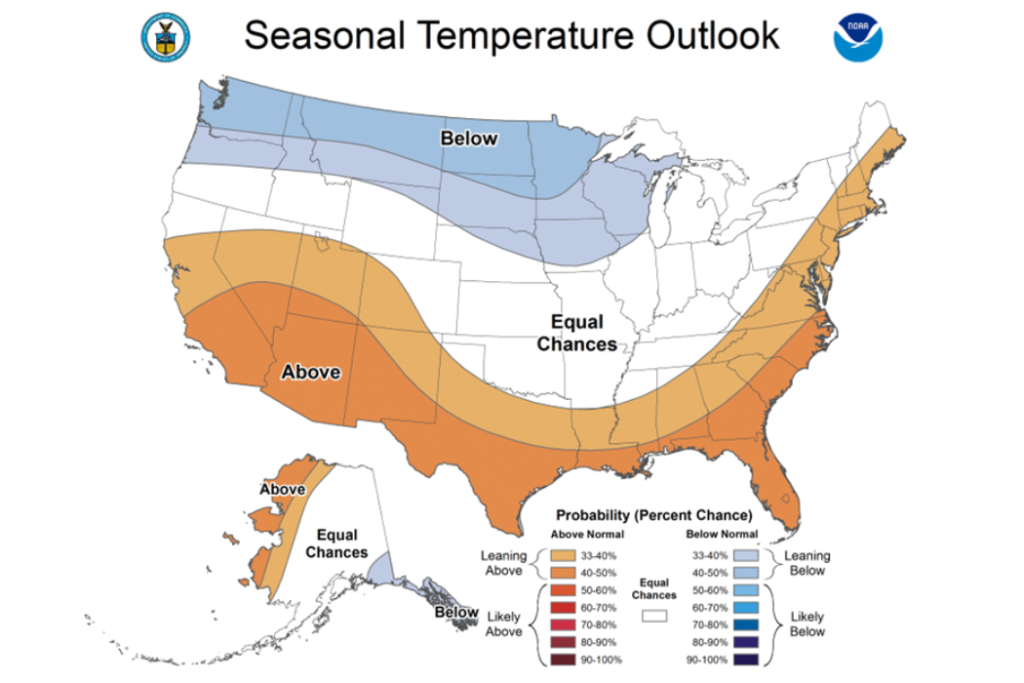

Winter is generally the most volatile season for energy prices as weather is the single most important driver of near-term natural gas prices. Forecasters are currently calling for a third straight La Niña winter, something that only happens every 10 – 20 years. La Niña, and its weather counterpart, El Niño, largely refers to water temperatures in the equatorial Pacific Ocean and both can impact weather patterns. A La Niña winter has cooler than average water temperature, but often brings warmer than average winter temperatures to much of the country.

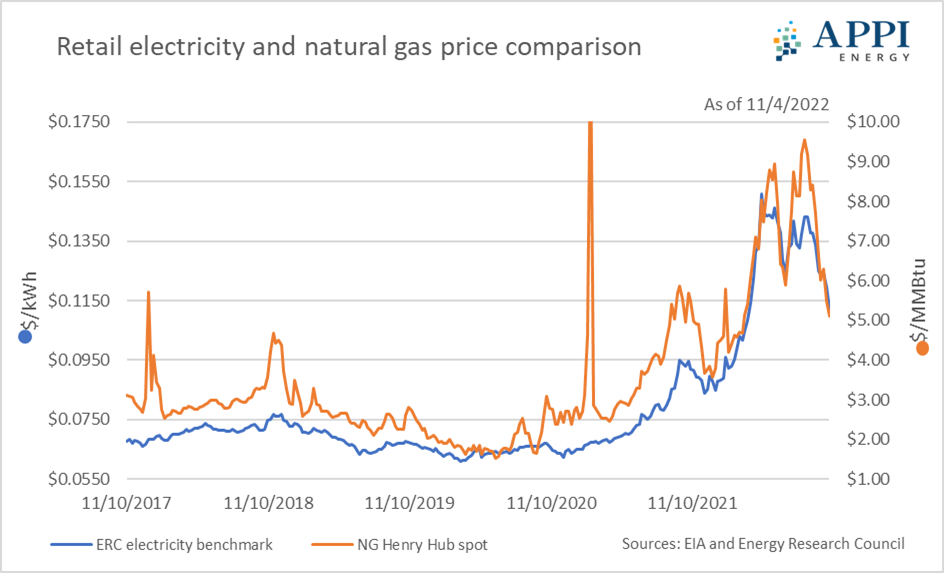

Of course, weather is not the only factor contributing to energy prices. Natural gas and electricity pricing are highly correlated so natural gas storage inventories, production levels, economic conditions and even geopolitical events can play a role in both natural gas and electricity prices.

The Impact from Storage Levels

Natural gas storage levels have been below the 5-year average for much of this year, driving prices higher. However, several factors allowed inventories to climb in the last few months. A fire and subsequent closure of the Freeport liquefied natural gas (LNG) export terminal kept 2 Bcf/day of natural gas from being exported since early June. Further, pleasant Autumn temperatures, along with demand destruction from Hurricane Ian, reduced demand for natural gas, allowing more gas to be put into storage.

On the production side of the equation, Exploration & Production companies have been slowly increasing the number of drilling rigs but have been constrained by investors turning away from fossil fuels toward renewables. Fears of a recession may further limit investment, particularly with regards to crude oil production, but this too affects natural gas supplies as natural gas is often a by-product of drilling for crude oil.

The Impact from Abroad

The war in Ukraine has had a dramatic impact on natural gas prices here in the U.S. as European countries have scrambled to replace natural gas previously imported from Russia. Prior to the war, Europe imported 40% of their natural gas from Russia. Prices climbed significantly as the invasion came on the heels of a cold winter in Europe and Asia, driving up demand for relatively inexpensive U.S. LNG.

The Bottom Line

Although predicting energy prices is about as easy as predicting the weather, the United States is entering what is expected to be a warmer than average winter heating season with improved gas storage levels. Additionally, production has returned to pre-pandemic levels and the country can’t export much more LNG than we currently are exporting, all of which should allow for some stabilization of price volatility. Still, it is important to remember the winter of 2020/2021 was also warmer than average, and just a few days of Winter Storm Uri saw energy prices skyrocket and sent a collective shiver through the entire energy industry.

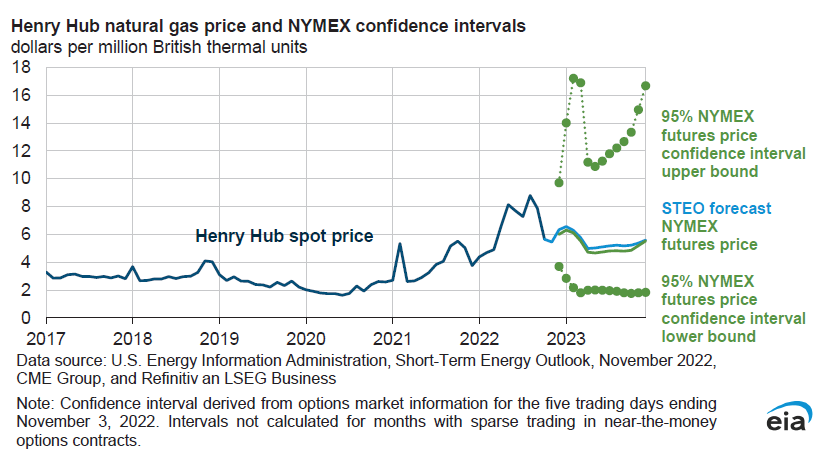

The chart below illustrates past and current natural gas prices along with the potential upside risk, and possible downside benefit, of significant price movement in 2023. Both the Energy Information Administration (EIA) and the market currently expect prices to average over $6/MMBtu this winter but dropping into the $5 range for much of next year as production increases in response to higher prices. However, the risk of much higher prices cannot be ignored as prices were in the $10 range as recently as August.

Next Steps

A prudent energy buying decision may be to layer in a portion of your future energy spend, while keeping an eye on the market and staying ready to lock in additional purchases as market conditions allow. By running nearly 400 Requests for Proposal per month, APPI Energy can do the heavy lifting for you and help you buy on the inevitable dips in the market.

Connect with our team today to explore your options. A no cost, no obligation call will only take a few minutes of your time and will allow our team to assess the options available to your organization to reduce energy costs and minimize budgetary risk.